The high level of penetration of the ECM solution within our business processes enables seamless linking of our departments.

Björn Gersch, Director Operations, Meyer GmbH & Co. KG

Solution: Invoice processing with enaio®

Many companies still process their invoices on paper. This results in increasing error rates, long processing times, and a lack of an overview. In the worst-case scenario, discounts can no longer be provided, and payment deadlines can’t be upheld. Moreover, invoice storage is costly. Switching to electronic invoices with enaio® can save a company up to 80 percent on costs and unleash unused labor potential.

The document management system enables quick, secure processing and exchange of electronic invoices. Review routines and digital workflows for notification and approvals ensure a high level of security and transparency. enaio® is a solution that detects incoming invoices (whether they are in electronic or paper form), distributes them automatically, and compares the data with existing data in the ERP or financial accounting system. The transactions and invoices can be directly linked with electronic records.

Realize significant time savings through digitized and automated invoice processes.

enaio® works together with established ERP and financial accounting systems.

Self-learning capture mechanisms optimize work during operation.

You can find all the invoice documents that need to be processed in the invoice inbox. Workflows support timely processing.

All invoice data is displayed in a clearly sorted way. The respective data status is always recognizable at a glance.

Send your invoices directly via e-mail, thanks to Outlook integration. To this end, integration with all common ERP and financial accounting systems is supported.

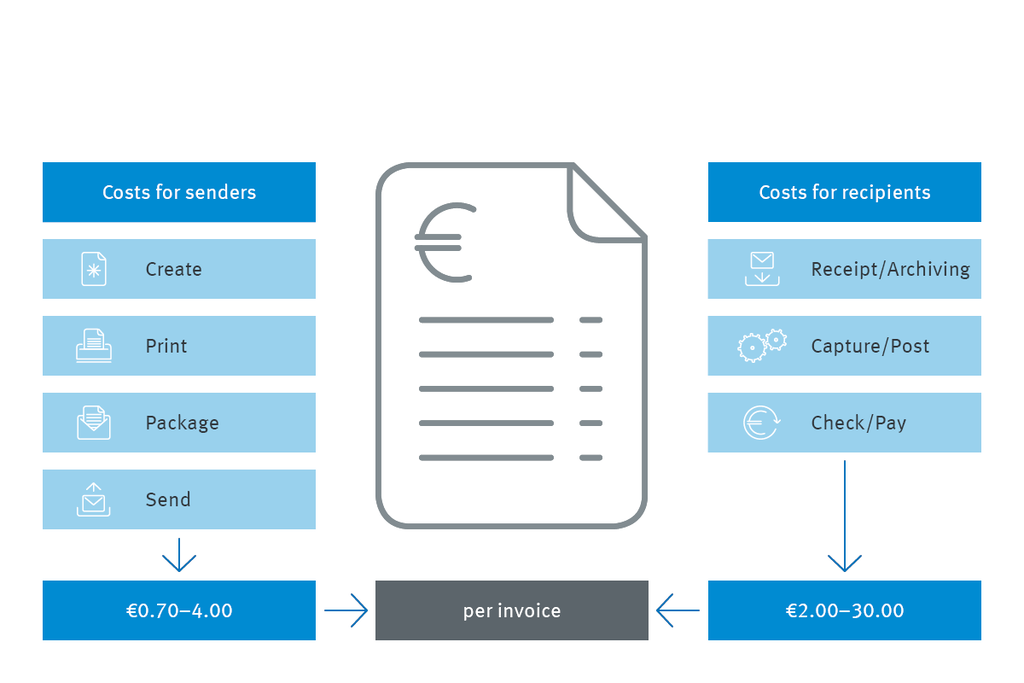

Potential for Rationalization During Invoice Processing

enaio® allows you to implement easy-to-automate solutions for incoming invoices in your company. Incoming invoices are digitized via batch scan and self-learning data extraction and automatically stored in the right context in enaio®.

Moreover, the captured data can be checked for plausibility and compared with existing data in the proprietary ERP/financial accounting system.

All receipts for individual posting records can be directly displayed in the respective ERP system (image enabling). Dunning and retention periods for the system ensure that deadlines are upheld and tasks aren’t left undone.

The documents can trigger workflows in the ECM system that ensure automated forwarding to the responsible editor. Substitution rules, follow-ups, and dunning periods ensure that nothing is left undone and that everything is transparently processed on time.

Elimination of paper-based mail distribution, transport and waiting times

Fewer incoming invoices lost

Shortened processing times through digital forwarding

Better use of discount periods

Automated data extraction and provision for leading data processing systems (ERP and financial accounting)

Interfaces for Seamless Integration

enaio® can be seamlessly linked with leading ERP and FI programs such as Microsoft Dynamics 365 or SAP. The integration enables efficient and smooth collaboration between the different systems. Invoices, contracts and other business-relevant documents can be transferred directly from the ECM to the corresponding applications, for example, to initiate purchase orders, post invoices or make payments. In addition, the link contributes to data consistency. Information is updated in real time and is available to all relevant departments.

Supported ERP & FI programs (selection)

Microsoft Sharepoint

Shortened processing times through digital forwarding

Audit-Proof Storage in All Formats

Once business processes are completed, the associated documents are archived in enaio®. All process-relevant information can be attached to the invoice (account assignment information, posting stamp, approval protocol, etc.)

enaio® thereby creates an important basis for audit-proof digital archiving through transparent process control in combination with corresponding process documentation. This makes it easy to implement the requirements of the GoBD, for example.

enaio® also allows you to handle paper invoices and import and automatically process various electronic invoice formats, such as ZUGFeRD and XRechnung, from electronic inboxes.

Digitize invoices via OCR, automated data extraction, and self-learning detection

Integration with popular ERP and financial accounting systems

Set-up of representative rules as well as dunning and retention periods

Integrated workflow management system

Supports various invoice formats (e-mail, PDF, ZUGFeRD, EDIFACT, etc.)

Lays the groundwork for audit-proof digital archiving (GoBD etc.)

The company introduced OPTIMAL SYSTEMS software to speed up data access and to optimize work processes. The manufacturing company with 1,750 employees has a very high number of ERP workstations, which is why the interaction of ERP and ECM is very important.